EPF Rules For Employer

WHAT IS EPF?

Employee Provident Fund (EPF) is a scheme regulated by using central authorities underneath ‘The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952′ which got here into impact from 1951 which extends to complete of India besides Jammu Kashmir.

EPF is one of the most really useful funding methods for salaried employee. Government has initiated EPF registration and made it obligatory with sure prerequisites normally for cultivating the habits of saving for all personnel working in personal sector, public quarter or even in authorities undertakings.

APPLICABILITY OF EPF

REGISTRATION beneath EPF is compulsory:

For each and every manufacturing unit engaged in enterprise using 20 or extra employees

For each and every different institution having 20 or greater personnel throughout preceding year.

For each and every worker who is getting much less than INR 15000/- per month.

CONTRIBUTION

Every worker who joins any institution which is protected underneath EPF scheme has to mandatorily make a contribution sure proportion of his salary.

These contributions have to be made regularly. The Contribution made through an worker is pooled up in the structure of saving or funding which is given to the worker at the time of his retirement or he switches his job.

Rate of Contribution for institution hiring personnel 20 or above :

Employer’s fee of contribution: Employer has to share his contribution at the price of 12% of Employee’s fundamental profits plus dearness allowance.

Employee’s charge of contribution: Employer has to share his contribution at the price of 12% of Employee’s primary revenue plus dearness allowance.

Not all of the employer’s share strikes into the EPF fund. Out of whole employer’s contribution, it is similarly bifurcated into 8.33% which is transformed to Employees’ Pension Scheme, and closing 3.67% is transformed into EDLI account.

Example: Any worker with simple pay equal to Rs 15,000/- (which is the most wages allowed for EPF deduction), the diversion is Rs 1,250 every month into EPS. If the primary pay is much less than Rs 15000 then 8.33% of that full quantity will go into EPS. The stability that is 3.64% will be transferred to EDLI.

Rate of Contribution for institution hiring much less than 20 personnel :

As per the EPFO rules, following institution has to make a contribution at the charge of 10% of fundamental profits plus dearness Allowance:

Establishment with 10 or much less than 10 employees.

An institution which has incurred losses throughout the give up of monetary year.

Such different enterprises such as:

Brick Factory

Jute factory

Beedi factory

Guar Gum Factory

WITHDRAWAL OF EPF AMOUNT

An worker on his retirement or accomplishing the age of 55, an character can withdraw the cumulative quantity of EPF account in his name.

He can withdraw the entire quantity in his EPF account alongside with the employer’s contribution.

In case the worker does now not reap the age of fifty five or is under fifty five or retirement age however switches or exchange his employment can additionally utterly withdraw his EPF stability in case he is no longer in employment for 60 days or more.

Now, an worker can withdraw his EPF quantity which previously was once offline and traumatic technique is now Online Easy and quickly approach of EPF quantity withdrawal. Following technique is to be observed for withdrawing the EPF Online:

Go to on-line portal https://unifiedportal-mem.epfindia.gov.in/ and login with the assist of UAN variety and Password.

The very first step after login is to confirm the KYC small print which are already uploaded at EPF organization portal.

Under ‘Online Services’ tab, one can pick through clicking and choosing “Claim (Form 31, 19 & 10C)” which is beneath drop-down menu

Form 31: This structure is used when worker needs to withdraw partly his EPF fund.

Form 19: This shape is used when worker needs to withdraw whole of his EPF fund.

Form 10C: This shape is used when worker wilings to withdraw pension amount.

Enter the final 4 digits of financial institution account below ‘member’s detail’ menu and click’ verify’ to affirm financial institution details.

Sign the certificates of undertaking.

Submit the on line utility form.

Once EPFO will scrutinize the financial institution important points with KYC details, EPF quantity request will be processed, which will be accepted inside 10-15 days & quantity will be credited to registered and confirmed financial institution account.

An worker can use this on line facility for withdrawal of EPF fund solely if his Aadhaar is linked to his UAN.

The essential purpose of EPF is to domesticate the habits of saving and worker need to withdraw the fund solely when wished and EPF fund is his ultimate resort.

REGISTRATION PROCESS

The step-by-step registration manner for EPF is as per the following:

1. EMPLOYER’S REGISTRATION

Registration beneath EPFO portal begins with registering an agency beneath Employer’s registration service. Go to EPFO reputable internet site https://epfindia.gov.in.

2. COMMON REGISTRATION

Earlier registration beneath EPF and ESIC was once achieved one by one which is now segregated by using EPFO by way of developing “Common Registration Under (EPFO & ESIC) which at once opens any other tab for single frequent registration of EPF & ESIC.

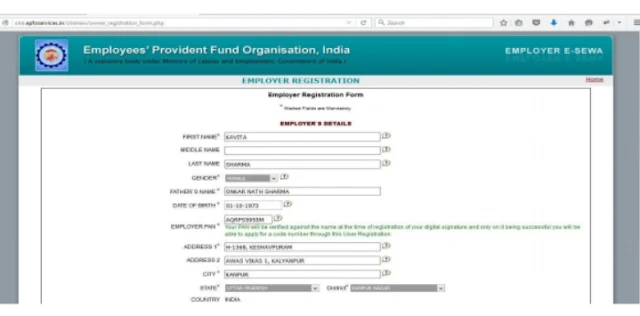

3. COMPLETE EMPLOYER’S DETAIL

First and main whole the first phase of software with the aid of finishing the small print of company and growing the User-id and password at this step:

Complete Details of proprietor such as Name, Address, Email Id etc.

PAN of employer.

Username has to be chosen by using an enterprise which can be used in future for login and return filing.

Employer will get OTP PIN on its registered Mobile Number which has to be entered for verification.

Last affirmation on E-mail has to be validated to prompt the employer’s login.

4. LOGIN WITH EMPLOYER CREDENTIAL.

After finishing the Employer registration and e mail verification go to EPFO legitimate website https://epfindia.gov.in and login with “employer’s login” for similarly registration of establishment.

5. REGISTRATION OF DSC

DSC of an organization has to be registered in an EPF portal with the aid of clicking “establishment” from the options. Select DSC/E-Sign from drop-down menu and proceed with DSC registration.

6. ESTABLISHMENT REGISTRATION

Complete the registration by means of finishing the important points of institution in an software and publish the application.

After Establishment registration, login by means of clicking Establishment Login for in addition compliances.

MONTHLY COMPLIANCES

Return has to be stuffed each month via following fundamental step. Return is stuffed on-line with the aid of doing institution login.

Return has to be crammed earlier than fifteenth of each and every month in ECR format.

Download the ECR sheets from ECR charge choice below drop-down menu of Payments.

Complete the downloaded sheet in XML by means of submitting the important points and changing into Comma-dilemma file in TXT shape for importing the same.

File the return via making the Contribution charge on-line without delay on an EPFO portal.

What is PMRPY?

Pradhan Mantri Rojgar Protsahan Yojna is a new scheme of authorities to encourage and incentivize employers via paying full employer’s contribution toward EPF & EPS. This is executed to encourage employers to create greater and new employments.

Does frequent registration below EPF & ESIC mandatory?

Yes, now the registration is clubbed as a frequent registration which has to be completed from the internet site of Shram Suvidha.

Which personnel are included beneath EPF?

Employees drawing simple wages INR.15000/- or much less has to mandatorily be included beneath EPF by way of Contributing at the charge of 12% and their return is stuffed each month.

Can an institution with much less than 20 personnel get register themselves beneath EPF?

Yes, these companies are included underneath voluntary registration. They additionally enjoys the much less charge of contribution which is 10% as in contrast to 12% of regular institution with 20 or greater employees.

What is the minimal pension received?

Under EPFO scheme, minimal pension is obtained through worker is INR 30,000/-

What is UAN?

UAN stand for Universal Account Number which is dispensed to personnel at the time of registering an worker below EPFO portal.

This variety is dispensed by using finishing the important points such as name, father’s name, aadhar number, Date of delivery as per aadhar etc.

This UAN can be used by way of an worker at some point of whether or not he modifications his carrier or establishment.

Comments

Post a Comment

Please do not enter any spam link in the comments box